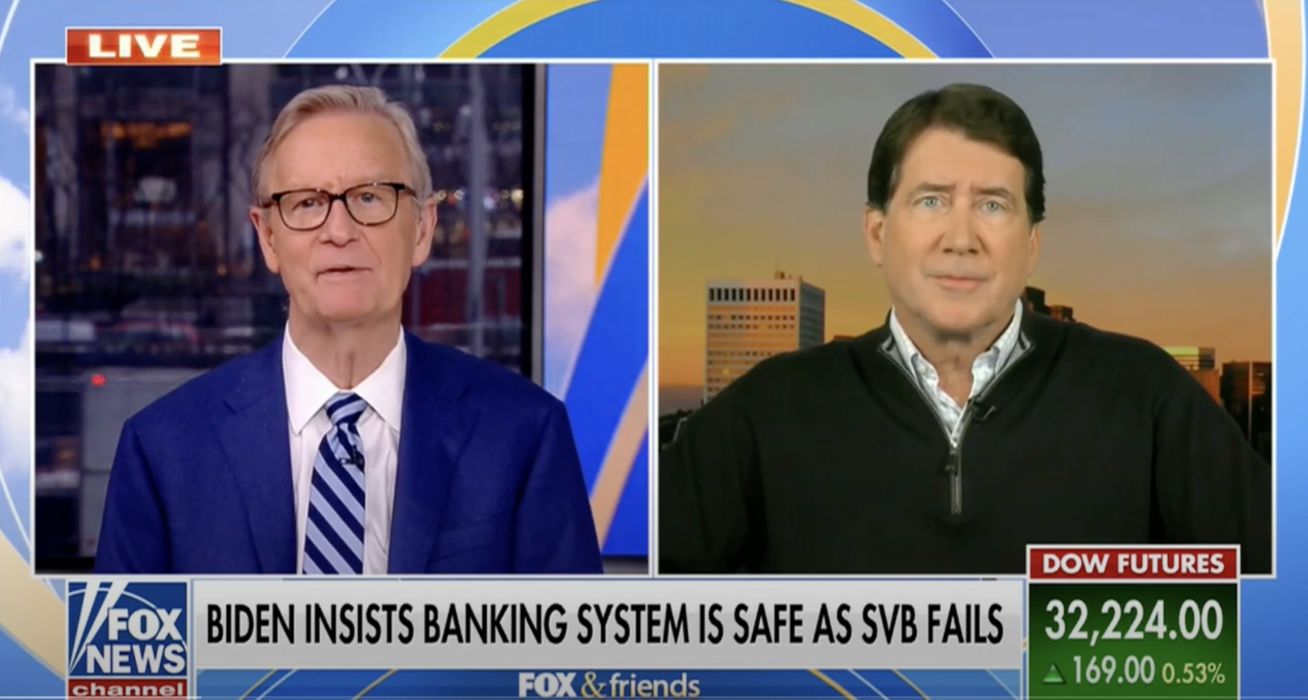

SAN FRANCISCO, CA—United States Senator Bill Hagerty (R-TN), a member of the Senate Banking Committee, today joined Fox and Friends on Fox News to discuss the collapse of Silicon Valley Bank.

Partial Transcript

Hagerty on the failure of oversight from the San Francisco Fed and Silicon Valley Bank: “There’s massive frustration here about what’s happening, but let me be clear: what did happen was a liquidity crisis, not a solvency crisis. The bank wasn’t insolvent; they just had a liquidity issue that turned into a run on the bank. This is something that should have been foreseen. Clearly, it’s a massive failure on the part of management. It’s a massive failure on the part of oversight. Where was the San Francisco [Federal Reserve]? And then what we saw happen this weekend was a failed auction. That’s another failure there too. We should have been talking about who the new owner of the bank was yesterday morning instead of being briefed by the Treasury [Department] and [Federal Deposit Insurance Corporation] officials about how the process failed and what we’re looking at going forward […] I think there’s a lot to ask. How is it that the San Francisco Fed missed this? Even private sector stock analysts were talking about the liquidity issues on SVB’s books as early as last fall. You know, where was the San Francisco Fed? They had detailed liquidity data available to them. They had all the tools necessary to step up regulatory oversight. I want to know what happened and why they did not do that.”

Hagerty on the Biden Administration’s mishandling of the crisis: “From a depositor standpoint, you’ve got to ask yourself. You know, the normal threshold has always been $250,000. But after yesterday, I think you’ve got to ask yourself whether there’s any such thing as an uninsured deposit in America anymore. The precedent that was set yesterday is going to have a far-reaching effect. You’re right. The investors in Silicon Valley Bank, the unsecured bondholders, they’re going to get zero. That’s the bet they took. The depositors, though, found themselves in a situation where they were uncertain. And the reaction of this Administration, rather than let a responsible bank come in [and] properly auction this and take over and work through the process, they decide to let the bank fail and put us in this new territory, unchartered territory. And, again, I think it’s going to turn out to be something that, at the end, customers are going to have to bear the brunt of this.”

Hagerty on the impact of the Biden Administration’s actions on American taxpayers: “The FDIC [facilitates the bailouts], and what happens is to the extent that there’s a haircut, that there’s a loss, and there will be, that’s going to be spread across all the member banks in America. Now the Biden Administration’s saying, ‘This is not a bailout. No taxpayers will be impacted by this.’ Where do you think those increased fees are going to be passed along? [They will get passed along] to the customers here in America, who, the last time I checked, Steve, are all American taxpayers.”

Hagerty on Silicon Valley Bank’s mismanagement: “I think what was happening here with Silicon Valley Bank is they must have taken their eye off the ball. We’ll get to the bottom of this, but their risk management function should have never allowed this to happen. They were holding far too many securities in what they called the Holds Maturity Bucket, meaning they never intended to realize the loss, but those securities were underwater, and they even got to a point where the bank had a negative equity value, and that’s where we are today.”

Hagerty on upcoming Federal Reserve interest rate hikes: “[Federal Reserve Chair Jay] Powell was before my [Senate Banking] Committee just a few days ago, and, at that point in time, I walked out of the meeting thinking certainly he’s going to raise rates by 50 basis points. I think after what happened with Silicon Valley Bank, and I think with this print coming in, at least in line with expectations, we’ll probably see a real serious consideration of perhaps slowing that down, maybe more like 25 basis points rather than 50 as we go into the next turn here.”

Hagerty on concerns of more banks failing: “That’s certainly not the case, and this is exactly what we did not want to happen. People look at these too-big-to-fail banks as the only safe alternative. That’s not the case. The regional banks are in far better shape. Silicon Valley Bank was an unusual case by many, many standards. And, in fact, I don’t expect this type of contagion to be broadly felt across the market. We were concerned over the weekend that if there were not clear answers coming out on Monday that people would begin rearranging their deposits, trying to get below the $250,000 threshold at multiple banks. I don’t think that’s going to happen. There’ll be some noise in the marketplace. I talked with Chair Powell on Sunday night. We both agreed there would be noise. It would be choppy yesterday, perhaps today [and] tomorrow. But I think the market’s going to digest this. I think it’ll settle down.”

###